Netspend Withdrawal At Walmart In 2022 (Limits, Fees + More)

Walmart’s current logo since 2008

|

|

Walmart Home Office (headquarters) in December 2012

|

|

| Formerly |

|

|---|---|

| Type |

Public |

|

ISIN |

US9311421039 |

| Industry |

Retail |

| Founded |

|

| Founder |

Sam Walton |

| Headquarters |

,

U.S.

|

|

Number of locations

|

10,593 stores worldwide (January 31, 2022) [2] [3] |

|

Area served

|

Worldwide |

|

Key people

|

|

| Products |

Supermarket , Hypermarket , Superstore , Convenience shop |

| Services | |

| Revenue |

US$ 559.2 billion (2020) [4] |

|

US$22.55 billion (2020) [4] |

|

|

US$13.70 billion (2020) [4] |

|

|

Total assets |

US$252.5 billion (2020) [4] |

|

Total equity |

US$87.53 billion (2020) [4] |

| Owner |

Walton family (50.85%) [5] |

|

Number of employees

|

2,300,000 (Jan. 2021) [4] U.S.: 1,600,000 |

|

Divisions |

|

|

Subsidiaries |

List of subsidiaries |

| Website |

walmart.com |

|

Footnotes / references [6] [7] [8] |

|

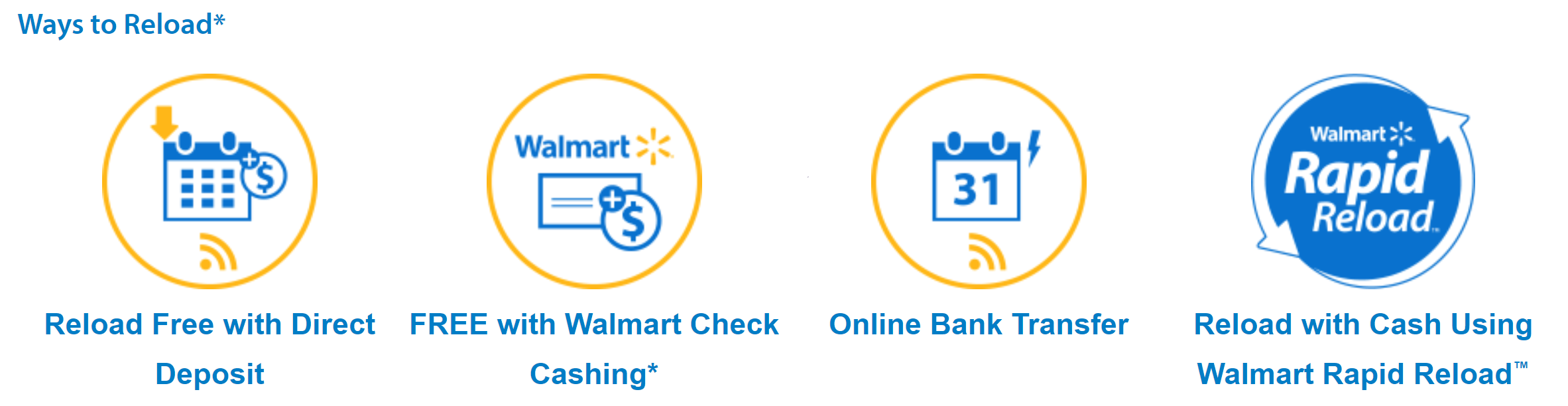

You can buy products online or in-store with the NetSpend Prepaid Debit Cards. These cards are accepted at all retailers that accept Visa or MasterCard debit.

Walmart MoneyCenter permits NetSpend withdrawals in excess of $4999.99 for $4.00 or 2.75 percent of transaction amounts. Additional cashback options include self-checkouts at Walmart, ATMs in Walmart, and cashback at registers. The pay-as–you-go customer on NetSpend is charged $1 to $2 for debit fees.

The easiest way to withdraw funds from your NetSpend account is over the counter at your local Walmart MoneyCenter.

Ensure you bring your physical NetSpend debit card and a government-issued photo ID such as a passport or drivers’ license. The cashier will release the funds once you’ve made the required payments.

Walmart offers cashback, so you can buy goods and get cashback at both the self-service or register. Most Walmart stores provide money back using your NetSpend debit card.

In the same way as regular debit cards, you can request cashback on self-checkouts. Enter your pin and withdraw the money you want. You’ll be credited your money if you are approved.

Walmart stores have ATMs that allow you to withdraw your netspend funds. As usual, use the ATMs at Walmart to access your NetSpend card.

ATM withdrawals have higher fees, so consider getting cash back from the bank instead.

Walmart’s NetSpend Withdrawal Limit:

The maximum NetSpend withdrawal limit is $4,999.99 per 24-hour at any over-the-counter location such as Walmart MoneyCenter.

In order to avoid having to withhold large amounts of cash, contact your nearest store ahead to confirm that they are able to meet your request.

Walmart enforces $100 cashback limits with any debit card purchase at an operated register, which applies to NetSpend withdrawals. Also, self-checkouts can charge $60 less.

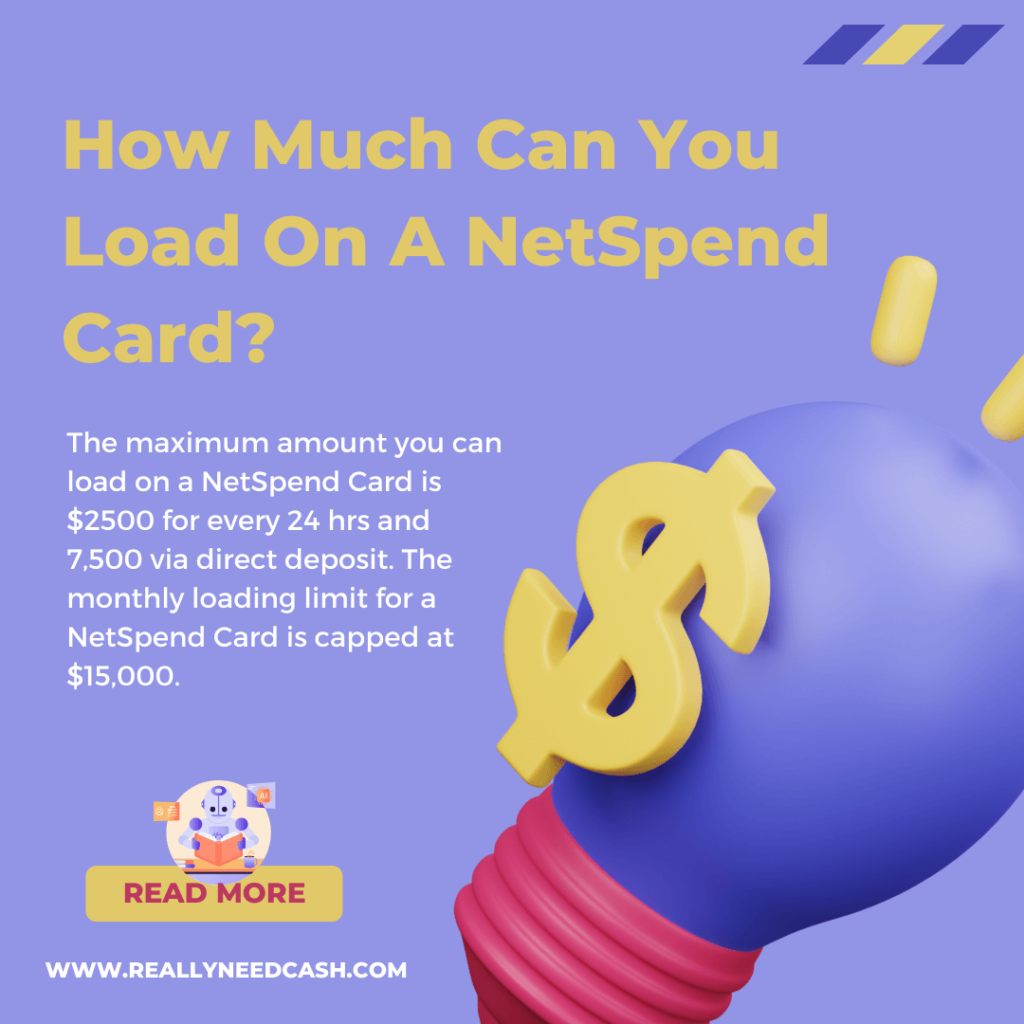

Users of NetSpend can withdraw upto $325.00 for completing Walmart ATM transactions. Customers are also allowed to complete 6 transactions per day, with a limit of $940 each hour.

Walmart Does Walmart Charge Fees for Withdrawing From A NetSpend Account?

The NetSpend withdrawal charges vary by Walmart depending upon the payment method. Walmart MoneyCenters charges fees according to NetSpend’s maximum limit. So, expect to pay $4 per withdrawal or 2.75%.

A NetSpend pay as you go plan will charge you $1 to $2 for each debit transaction. For customers who subscribe to the Monthly Plan, or the Reduced Monthly Plan, fees are not applicable.

Walmart ATMs charge an operating fee between $2.50 and $3 for every withdrawal. Since they’re not connected to any regular network, ATM withdrawals are charged by NetSpend at $2.95

How To Withdraw NetSpend Money For Free At Walmart?

The cash back or self-checkout options at Walmart are both available to avoid the NetSpend withdrawal fee. To avoid debit fees from Netspend, ensure you’re not on the Pay-as-You-Go plan.

The money center will accept netSpend funds for $4 (or 2.75%) of total amounts taken. You can get up to $4999.99 per 24 hours. Customers may also ask for cash at the register, or by self-checkout. Draw up to $100, with debit fees as low as $1 or $2. Alternatively, withdraw from a Walmart ATM. Maximum 6 transactions of up to $940 are allowed per 24-hour.

How do I make a lot of money with my Netspend Card

The easiest way is to either withdraw the cash from your ATM or make a withdrawal using your Card Account. The funds can be requested via mail (mailed in 3 to 4 weeks). Recipients of checks will be charged $5.95 You can close your account by calling us at 1-866-387-77363.

What is the best place to withdraw cash from Netspend?

MoneyPass ATMs will allow you to withdraw free of charge if your MoneyPass Netspend ATM cards are present. You can use the ATM locater in your app to find the closest ATM point.

What is the Netspend Fee To Withdraw Money

Netspend users are charged a $2.50 domestic ATM cash withdrawal fee. There is an additional ATM transaction fee of $2.50, but this does not apply to domestic ATM cash withdrawals. It can be anywhere from $2.50 to $5, depending where you withdraw. An international ATM will require you to pay a withdrawal fee of $4.95.

.Netspend Withdrawal At Walmart In 2022 (Limits, Fees + More)